I see AI as Applied Intelligence rather than Artificial intelligence.

In my view intelligence only exists in the mind; it should be applied but isn't artificial.

|

open |

open |  closed(at times contains errors)Change less than 0.1%

closed(at times contains errors)Change less than 0.1%

| 04-07 | 03-07 | 02-07 | 01-07 | 30-06 | ||

|---|---|---|---|---|---|---|

| U$ | = | 1.3605 | 1.3575 | 1.3622 | Bank holiday | 1.3643 |

| € | = | 1.6022 | 1.5958 | 1.6048 | Bank holiday | 1.6030 |

| 元 | = | 0.1899 | 0.1894 | 0.1901 | Bank holiday | 0.1904 |

| B£ | = | 1.8567 | 1.8521 | 1.8550 | Bank holiday | 1.8699 |

Since working with currencies around the world I've been thinking about how to reconcile changing values over time.

I've decided to think of a global currency based on the long history of economics, Gold. For this golden ( ) I've settled on the value of 1 decigram of gold. The table (updated weekdays about 4:45pm) shows the value of this

) I've settled on the value of 1 decigram of gold. The table (updated weekdays about 4:45pm) shows the value of this  in a variety of currencies, the value of 1¢ golden was about 8¢ Canadian at the time this was written. A reasonable value from my point of view, considering a nickel is the smallest coin now used. Canada eliminated use of the penny coin in 2012 with cash payments rounded to the nearest nickel.

in a variety of currencies, the value of 1¢ golden was about 8¢ Canadian at the time this was written. A reasonable value from my point of view, considering a nickel is the smallest coin now used. Canada eliminated use of the penny coin in 2012 with cash payments rounded to the nearest nickel.

This invented currency provides a practical base for keeping a clear view of how currency and cryptocurrency relationships around the world are changing and if some such currency were legally adopted by international agreement for global use it would eliminate currency value manipulation and ensure a more dependable monetary system.

Bitcoin ~ U$108,062 at 02:39pm EDT

Historical high: ~U$111,943

As of 22-05-2025 there are almost 90 cryptocurrencies per country

& many claim that cryptocurrencies supplant money!!!

Market capitalization of cryptocurrencies according to forbes.com

16 June 2025: tracked 17,415 valued at U$3.48 trillion

22 May 2025: tracked 17,175 valued at U$3.65 trillion

7 March 2025: tracked 17,175 valued at U$3.0 trillion

3 February 2025: tracked 17,049 valued at U$3.47 trillion

10 January 2025: tracked 16,589 valued at U$3.43 trillion

2 December 2024: tracked 15,812 valued at U$3.64 trillion

I consider cryptocurrencies to be like imaginary casino chips with no fixed value and they have become a legalized form of counterfeiting.

At this time of writing there were more than 17,000 of them; that is almost 90 cryptocurrencies per country. Does any country need so many forms of money?

I see the answer lies in only one global currency, based on the value of gold, usable for all economic purposes in the global system. I don't expect to see it while I'm living here, as the established monetary and exchange system doesn't want, and is so hard, to change.

Cryptocurrencies are products of the imagination.They are dependent on the belief in the illusion that permits the creation of them, are very volatile and values differ at different websites.

I see a lot of authorities and others trying to force regulation of cryptocurrencies. How can any government legitimately regulate what amounts to producing counterfeit money.

Of the thousands available, it is very difficult to identify the issuing body of cryptocurrencies, and I see no legitimate basis for the issue. I expect them to have momentary value depending on the social illusion that each has; but eventually most participants will be victimized by the process and eventually they will almost disappear.

The best example that I compare them with is the popularity of chain-letters when I was in high school. Although chain-letters still appear in some form most people do not succum to the promise they offer; it is false and most people know it.

Pyramid schemes are another such attraction that has survived for a long time. Although far less popular now than 30+ years ago they still find victims that invest large amounts with little return to any but those at the top. Some people I knew tried to be my friend, but when I didn't become subject to their pyramidal scheme they took their 'friendship' elsewhere. I have seen a popular North American herbal company that uses this system that also still does business in China.

Another factor I consider is tulips in period during the Dutch Golden Age when contract prices for some bulbs of the fashionable flower reached extreme levels from 1634 to the sudden collapse in February 1637.

Another comparison was with issues of company currencies that had value only in specific locations where the company chose.

Money is a necessity of community life but I use gold as the most enduring form of a monetary asset, which has thousands of years of history, to preserve some wealth, because I learned it is used to keep a fair accounting for the lifetime Ḥuqúqu'lláh contributions.

Eventually there will be one global currency based on gold that fulfills the economic needs of a single world community; but the people dependent on the currency exchange system and the segmentation into ideological groups as yet keeps this desirable tool out of public consideration.

Government issued currencies are necessary until then, but they do have serious and divisive problems. At least they are backed by the lawful existence of the issuing authorities and are supported by national assets.

I'm not a gambler so not participating in the markets

or in crypto-currencies

I see them as casinos in a society with many addicted to gambling

Began in the spring of 2021 Originally intended to be a prediction. Changed to a statement of views with the unraveling of global relationships continuing for so long.

14 April 2025: I've reached the conclusion that the world I'm living in is most likely to endure, far beyond my life, in the conditions of divisiveness. Though there is only One Creator, as preached by almost all, the generally immature conditions of human life here remains in a divided and warring state. Even though many people believe in God (of which there is only One) there is a great difference in the view and interpretation of the followers of the great numbers of religious organizations, and the differences between these organizations is seen as paramount.

I now recognize that even the followers of the most recent, and New Age revelation, still cling to the idea that personal power over others is significant, and refuse to see the equality of all humans in the eyes of God.

9 April 2025: Today there is a great relief with a tremendous upward change in stock market prices due to a sudden tariff reduction by the USA.

I've looked at the major US indexes for periods of 1 week, 1 month, 6 months and 1 year. They are mostly up only on the year while most have gone down for 1 week, 1 month and 6 months.

Due to the sudden great upward percentage today (while the so called volatility index went down 36.12%; proving it to be an indication of market index reduction) I am more convinced the stock market is a gambling system influenced by leaders that matter to the people that are trying to win money.

8 April 2025: The trend of market factors presented on tv at this time is mostly typical of the past decades, but the reintroduction of high and controlling tariffs is now the point of general contention and contributing to the unraveling of global relationships. The general tendancy is the presentation of market and other economic moves with exagerated effects and attempts to elucidate the impossible fight for control.

A few percentage points of change is presented as a great move. A view of the change over a longer period of time shows a much different change than the one being presented. The fight for control completely disregards the truth of the oneness and diversity of the planetary social structure that is now becoming evident and our maturing into a society of equal, but diverse, people.

My view of the current situation requires a much deeper consideration than previously thought. The general opnion seems to be sensing the need for certainty where it is impossible for such to exist. The leaders of most countries and other influencial groups are proving to be untrustable and are fighting for their followers to blindly follow. The basis of values they exhibit are mostly based on monetarism rather than truth. In fact the recognition of the value of truth is definitely avoided.

23 December 2024: Squawk Box, on CNBC, has finally produced a segment that recognizes the adictive nature of the stock market and cryptocurrencies.

The early morning program identified the problem as the "CRACK COCAINE" of the markets.

Gunjan Banerji, Wall Street Jounal, was the woman who described the problem.

They skirted the over-all view that the whole Wall Street market was nothing but a gamble but clarified that many were close to suicide because of the losses, and seeking professional help to deal with the situation. The situation was stated as 'new', yet I've considered this as the true situation for a few decades and now see it as the basis of stock markets from their founding.

However, they did identify the fact that many new products were added to the gambling situation, and compared the situation to Las Vegas.

10 August 2023: I didn't expect this financial delusion to last so long but now see it may prolong for a few years yet.

Facts are being presented in a way that obscures the truth. The justice systems are being manipulated to allow special persons to remain criminals at large.

The poor mass of humanity is increasing but out of the public view.

22 February 2022 Looking at the Dow Jones Industrial Average now I see another decline that takes it to a low last seen about 18th June about eight months ago. It is still way above what I thought was a sky-high value of 15,000 back in 2013. I expect an historical crash some day but can't imagine when.

The continuing manipulation of money creation around the world and especially in the US exacerbates the excesses of wealth and the hardships of poverty everywhere that some day must be reconciled. I expect a social revolution that will persuade the influential in humanity to establish a new order much like happened following each of the World Wars. Hopefully the outcome will be much more fair than the League of Nations and the United Nations. Perhaps even a more secure global system of democracy that will not allow a privileged veto that ensures the continuation of superpower control by warfare.

21 February 2022 The past while has seen the NATO countries, led by the US using intimidating behaviour and threats trying to force the intimidation of Russia against Ukraine to be withdrawn.

We have yet to see the outcome of this issue, but I can't imagine anything good.

Both sides are ramping up the hostility. Both are deploying hostile forces to the area.

In my lifetime I have seen many times where European counties have tried, with varying degrees of success, to require the US to reduce its occupation of Europe. The current dilemma is providing the US with a reason for reinstating much of its domination.

I see trouble increasing on all sides and see that Canada is also responding as one of the minions to the US.

I mention this here because I deem it to be a contributing factor in the global economic battle that is intensifying.

27 January 2022: Perhaps the government inflation of stock market prices is past the peak. The Dow reached a record high of 36,952.65 on 5 January this year and has since receded and the Fed is now appearing to the mass of financial analysts to be "Hawkish". Perhaps we are now on the precipice of the economic disaster I imagined that the world must endure to become somewhat healthy and mature.

As with the environment, the economy is a global system. The failure of nations working as a whole will continue to exacerbate the problems for many decades or centuries to come; but it is not due to the lack of access to the science and principles needed to build a good system. It is due to many prejudices that are adhered to in organizing the bodies that are conflicting for control.

Perhaps this year will be the start of the greatest economic rectification of this era of modern ideological politics.

I can't see the divergence of wealth from the mass of human well-being continuing to increase much longer.

The media has generally been presenting the conditions to be either exciting or dreadful but definitely intense for a long time.

24 December 2021: As the old year comes to an end and I review my market expectations for the year, I see that things have gone much as I expected.

The stock markets around the world have risen to exceptional values even though the economy of the world is in one of the most challenging times in history.

Government officials are more at each other's throats than ever before, yet promote the creation of illusory forms of money that appeal to the greed of gamblers.

The rule of law and order has been discarded more than ever before, led by the disintegration of social relationships in the US.

I expect these conditions to worsen for a few years at least before people everywhere begin to discard the economic, cultural and status prejudices they strive to exalt themselves with.

22 Aug, 2021: The Dow Jones Industrial Average is remaining above 35,000 most of this month.

Eventually a world currency, founded on the value of gold, will be instituted and these economic delusions will finally become a thing of the childhood of civilization. Maturity will prevail but not for centuries to come.

I expect the Dow to continue climbing with other markets around the world for the rest of this year and perhaps a year or so longer. However, it is not an economically driven reality. It is the pouring of money from newly created public funds that is driving it and will one day need to reconcile with reality. The distortions in many facets of global life will eventually be brought in line with science and reason. The situation in Afghanistan, though dire and undesirable, demonstrates the impossibility of one nation continuing to try running the world. Similar signs are emerging in other places, especially in Japan, Korea and throughout the Middle East, South America and Africa; wherever imperialism is practiced.

Eventually democracy will also develop universally so that all individuals have the same rights to participate in social governance, and party affiliation and ideological segregation will cease to control others. The system of government will be freed from privileged forces and truly democratic institutions of administration will be formed. But this too seems to be a far future condition.

Spring of 2021

I expect the Dow Jones Industrial Average to reach about 35,000+ by summer. Gambling is prohibited for me and the stock markets and cryptocurrencies are a casino so I just observe and prepare for the consequences.

I see the flow of money from the governments to improve the state of wealth but believe it is unsustainable. As the years progress with these interventions the outcome will become more dire. They are inflating the value of market instruments beyond any imaginable worth and the return to reason will make the Great Depression look like a minor event.

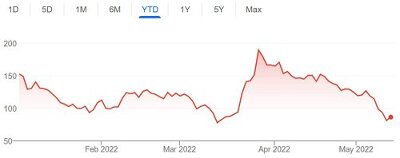

Grim Thursday 4 May 2022

(Dow at low lost more than 4% from previous close)

Are we now in the economic Frenzy

that began in 2022?

Grim Thursday, 4 May 2022 details at the bottom of this this page

15 January 2025, I didn't expect most of society to be so blind for so long to the criminal aspect of the leading forces in this world. The claimed "Greatest Country", as well as most others, is being led down the garden path. The claims that Canada and Greenland may become parts of the United States of America are causing great concern, especially among the residents of these two countries who don't want to become Americans.

With the new administration of the United States about to come into power we should soon see what happens.

The intended nature of our world community generally remains out of sight and more and more reminds me that the outcome of Sodom and Gomorrah may be representative of God's way of dealng with the current situation. Such an outcome leads to the fact that mankind has free will but God has a way to deal with it.

10 August 2024, I'm surprised at how long the stock market has continued to rise. It is now far beyond any value that I see as reasonable, yet on TV I see mostly people pushing the idea that it will go further.

The average stocks are currently rated at 20%-25% earnings with some as high as almost 40%. My view about 50 years ago was closer to 10%, and I thought that was too high. I've also owned a few stocks (eg. Northern Telecom) that have become worthless, even disappearing from the market and the money invested has been lost.

My choice for a long term security is gold bars. They may fluctuate widely in value but for thousands of years gold has never been worthless. It has always been a store of great value.

My expectation to see the market get to be a more real representation of commercial value but it will remain a gambler's den has gone in the wind along with environmental improvement. It looks like I'll die long before a serious correction.

15 December 2022, It appears to me that the illusion in most so called investments is being stripped away, slowly and not without a strong resistance. For many decades the stock market, financial instruments and finally cryptocurrencies have been developed with mentally created values that have no basis in the material universe. They have very little reality and are part of the gamble for riches. The world of finance is mostly populated with people playing the game. It remains to be seen where this will go, but the conflict for riches is very evident.

14 November 2022, Last week I failed to see the comming G20 meeting in Bali. It is an event that requires countries to look as strong as possible and I should have taken it into account when predicting the movement of the equity markets.

Now that I see the meeting of the presidents of China and the US it becomes clear that there would be an observable rise in values.

It adds a very complicated influence for the movement of the world economy.

Even though there is so much pressure for nations to look economically strong, there is a lot of weakness and other troubles visible.

9 November 2022, Now that the US elections are over and there is no possibility of agreeable governing, perhaps the false inflation of stock values will become more difficult to maintain and the descent to reality will resume. The increasing recognition of cryptocurrencies having an illusory basis for existence and the falling of their monetary values is also exposing credit failure and troubles on a massive scale. We may see a widespread severe downfall of economic delusions. Though the Ontario Teachers’ Pension Plan faces a hit on investment in FTX, Cryptocurrency exchange Binance faces proposed $1-billion class-action lawsuit and a Binance-linked blockchain was hit by a US$570-million crypto hack, many officials and institutions are still trying to establish and/or recognize this as a legitimate form of counterfeiting of money.

I think we are approaching another period of economic education.

24 October 2022, With watching the news, financial programs and seeing the political situation, I expect to see the financial markets to go up in value until the American federal elections. Once that is over it is likely we will see a resumption of economic, along with the political turmoil. We are still far above common values among the privileged where such values come into play. The reality of a loss of power for the privileged to dictate such things will likely continue and the approach to a fair economic world, among other things, will resume once the elections are past, I expect.

5 October 2022, The Frenzy intensifies! We are now into October and people are getting more unpredictable and quarrelsome. The idea that justice should prevail has been lost at the higher levels and law and order is developing to promote benefits to the privileged, deteriorating common human life. National governments, key ideologues and influential bodies are at each other's throats with the idea that physical supremacy is the greatest purpose. Science without reason is being promoted as the final path to the future. The physical world is reacting with intensifying storms and environmental problems. There is no relief in sight.

23 September 2022, The institutional economic predictors are finally admitting that the stock market futures are much lower than previously forecast. The attitude of the Fed to reduce inflation and the continuing rising of borrowing rates for the privileged around the world is causing the professional prognosticators to say that we are headed into a period intended to reduce inflation. Whether this will cause some rectification in leveraged wealth, the reduction of excessive wealth and the beginning of an equitable society remains to be seen. Hopefully it will begin to develop social understanding and administration of economics that more fall in line with the truth that wealth is a social science and regulate the economy so that it is equitable to all rather than for the privilege of the powerful few (though many in over-all effect). One of the most mis-understood claims I've seen recently is the one claiming that there is likely to be a study of poverty to help develop governance to alleviate it. I know from experience that no-one officially engages seriously with destitute people. When I was destitute for a long time it was like being socially invisible. Seldom did anyone engage seriously with me and I was mistreated by authorities when I sought help.

18 September 2022, The grim situation of the economy is still a concern of mine. I see this as a part of the terrible state of the world society with no improving of social thought in sight.

The past 6 months have confirmed the grimness of the situation. The political rhetoric intensifies; the ideological positions become more hostile; the absence of ethics and morals becomes more apparent. The goal has no virtue in sight.

The general expression is that we are headed for a cliff; little realizing we have gone over it and are in freefall, even though there are occasional strong updrafts that improve the view.

29 August 2022, I see a lot of authorities and others trying to force regulation of cryptocurrencies.

How can any government legitimately regulate what amounts to producing counterfeit money.

22 July 2022, I've been analyzing the values of a few indexes to imagine where they should go. Below is my presumption of what I consider as comfortably overvalued.

- The NASDAQ: ~8,000. Now ~11,789

- The DOW Jones Industrials: ~27,000. Now ~31,798

- S&P 500: <3,000. Now ~3,946

If they reach these levels then a reanalysis would be appropriate.

As for crytocurrencies: I've yet to see a better description than they are as casino chips with no fixed value in a casino run by corrupt people.

3 July 2022, The idea that we are in, or heading for, an economic ression is absured to me. The economic problems we are experiencing go far beyond such a consideration.

The global community situation and social conditions are much more grim than any popular way of presenting them. A state of war, such as never since WWII, now exists between and among most major and minor political groups. The Superpowers are at each other's throats. Bombs and other weapons are being used indiscriminately. Armed killers are running rampant in some countries. Many people are being violently killed. The COVID-19 pandemic is still raging around the world causing even more loss of life and sickness. Economics are being mismanaged in order to preserve inordinate wealth while hardship on the rest of society is increasing.

Almost all aspects of life are deteriorating while most people choose to create divisions and refuse to participate in, or even try to understand, the right way forward.

Science is selectively presented to support political intent, and biology is commonly presented as a matter of choice rather than as a scientific fact. Freedom is believed to be conferred by others through choice or force rather than as a matter of personal reality that can be neither given nor taken.

I expect this process of social deterioration in many aspects of life to continue long, well beyond my death, before humanity chooses to see the Light, change their beliefs, and act in a good way. Creation, though including a process of free choice in the human realm, is a divinely intended process and will eventually reflect a great reality in this world. We are but on the virge of maturity that will eventually become evident, though the process of maturation be very painful.

28 June 2022, Now that I'm back from the rockhounding trip with Lindea to the US I'm looking at the economic conditions with a wider view. Much of what I've seen I believe to be the conditions around the US.

- Gas prices are very high, yet many people are travelling.

- Many wind turbines were idled—leading me to believe consumers have reduced consumption.

- Wireless phone companies are generally requiring upgrade to G5 capable phones; but providers are still selling lower services and then blocking these services once subscribed but refusing to refund the fees taken, as I found out with T-Mobile loosing more than C$100 to them.

- Stores are short of some products but many shelves are overflowing with others.

- Many businesses have gone.

- Prices are high.

- Many retail workers are discontented and avoiding customer contact.

Some of the rich are getting richer but many are loosing wealth. The burden on the poor is increasing, as is division of thought and refusal to believe that truth can prevail even when provided with truthful ideas.

The appearance of devaluation of equities continues as I expected; even with the G7 summit taking place with leaders wanting the economy to look good.

I continue to resist paying for services from extortionate compaines even when it results in restrictions on my life, and hope others do likewise.

13 June 2022, It appears that the world financial leaders have lost focus in the public forum and now can no longer sustain the money supply that supports the customary increase of wealth and burden on the poor through bull markets. The global financial markets have resumed their shrinkage, but the privileged wealthy are still raking it in through gains from higher consumer prices, especially oil products. Yet the decline in financial instruments is likely to impact those relying the most on leverage debt for wealth. I think this is one of the most significant sectors that only becomes a concern when conditions like these develop.

Mostly I see wealth being used merely as a social status symbol, and sometimes for social power, but seldom as a benefit to humanity—which is best.

At present the stock markets, in my estimation, should be valued at less than half of current indexes. That would be painful for those most reliant on the image of the current market values. As for the wealth generated by many financial creations—they are but an illusion for others; I rather live in economic reality.

When, as has been the case especially during most of the last 30+ years, the influencers of the bull markets prevail, I wonder what will be the correcting process.

There is no scientific understanding that I see in the dialogue on business TV. It all looks to me like they are trying to create social illusions to make the markets for equities go back up. I belive the economy is based on scientific forces. The illusions of thought have been very influential throughout the history we can see, but the human mind is still immature and economic science remains mostly hidden behind the curtain of ignorance. People are trying to have individual benefits regardless of the ethics or effect on others.

We still can see the upheaval of most social realities in the world.

26 May 2022, It will be interesting to see how long, if ever, the financial market values return to falling.

Today is the final day of the Davos economic forum so I expect the pressure from officialdom to recede over the next week or so and regular social pressures of despair to return as the most influential force.

As for the Davos forum, I believe it is time to set the 'single objective of building a more sustainable, inclusive world' to include the idea that the inclusive world should have an administrative body to enforce peaceful relationships that prevent attacks of any country on another.

25 May 2022, It's time to consider the effect that the World Economic Forum Annual Meeting may be having on the world's financial markets. The meeting ends tomorrow so now is a good time to observe the situation as reasonably as possible, consider the personalities involved and speculate on the characteristics observed, while analyzing the facts as they appear throughout the world.

With the US markets being the most influential, they are mostly up in the past week, but for the NASDAQ which at the moment is slightly down. Asian markets are up, as are those of Europe. It all looks very good. But these are not natural results that come from current activities of social behavior. We are living at a moment in time where these things are not the result of scientific influences, but the result of highly abnormal administrative choices that cannot be sustained.

The international atmosphere is deteriorating. Ideological conflicts are becoming more intense. The need for social justice, in economics as well as most other fields, has become replete. The delusions that have been effected for the past few decades are now the cause of growing conflicts and disintegrating relationships. The interdependence of all nations cannot be dispensed with while new attitudes, integrity, ethics and behaviour must be employed in the development of new institutions, as yet beyond political imagination, for the administration of a unified world. We are passing through one of the most profound and intense developments in global relations in the history of social evolution. The outcome is a foregone conclusion but the ways and means are not. We need to deal with the ways and means! My attempt to tune in and harmonize with to the Divine Will is my choice of dealing with these matters. These elucidations of my opinion are a way of participating as an influencing member of this global community.

24 May 2022, Live in the moment — dream in eternity! This is how I'm seeing things today. I'm thinking of such things because of the media presentations about market values and what appears to be persuasion to invest for future dreams and ignore the corrections that are causing great losses by staying in the markets. I got out just before the bubble burst of 2000 and have seen the marketing of illusions since then. These illusions, however, have not prevented me from being a foreign business owner in Hong Kong for a China property developer.

Being a stock holder requires careful thought, and even then mistakes can be made.

23 May 2022, With today being the 178th aniversary of the declaration of the Báb it is a special day for me.

I also consider the economic situation we are in. One new conclusion I have gained is the view that we have gone into a period of time where values of market instruments and wealth are being mainly influenced by personalities and market institutions.

It strikes me as sad that economic science can be so ignored while delusions of the mind hold more sway and personality allegiance is more desirable in the public domain.

The idea that the US economy is strong and that "storm clouds" may dissipate appears to me like trying to persuade people that a sunny day is wonderful as storms are building, and hurricanes and tornados are on the horizon. It is a time to hunker down rather than shopping for beach wear.

17 May 2022, It is a time to wonder!

- Is it a wonder to see airline stocks increasing while I'm refusing to fly at the prices they charge and a pandemic continues?

- Is it a wonder to see Berkshire Hathaway stock at 472,006.56, down more than 13% from its high of 544,389.25 and they are now making a bet on C and PARA?

- Is it a wonder to see Walmart fall more than 17% from a recent high of 160.77 under fears of great inflation affecting their shoppers and failure to meet profit expectations—yet the market is so high?

- Is it a wonder to see the stock market go back up while market prices are obviously very high, during this worst global social conditions in memory?

- Is it a wonder to see the manipulation of economic affairs — by government and financial institutions?

13 May 2022, I see today as the epitome of a "Dead Cat Bounce" or relief rally. We shall see. I don't see any economic improvement to account for it. I know there are rich people whose pubic image relies on the wealth they own who buy market instruments in an attempt to push up the prices. It works to some extent, but ultimately cannot produce the illusion intended.

12 May 2022, The media focus looks like we are now living through an historical moment of economic metamorphosis—perhaps the greatest in recorded history. I'm now thinking it is my job to document what I see happening as it happens, and how the influencers are responding to it.

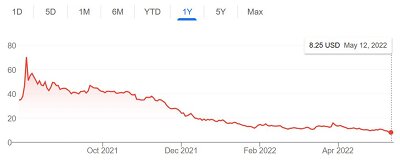

One of the top of mind issues I see is the attempt to evaluate cryptocurrencies.

To me cryptocurrencies have no economic or scientific basis of value. Regardless of whether they are claimed to be pegged to the dollar, they exist only in the mind. Even pegging them is a creation of the mind. We now see that Stablecoin's peg has failed and cryptos are failing to retain value, but cryptos are a side issue. I see them as gambling platforms. The best example I've seen is apparent at coinbase.com where on the homepage it states "Create an account for a chance to win".

The public dialogue shows how disturbing economic, and social conditions in general, are. I expect there will be noticeable increases in market prices at times, but consider the outcome after a few years will be much lower—at least in terms of global values.

I'm hopeful that knowledge and practice of economic activities will become more mature and the welfare of humanity will become healthy as never before.

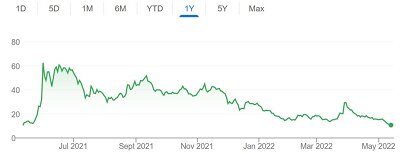

I think these images should elucidate the public image that is being cultivated by the media when they use the term 'surging'.

11 May 2022, Volatility—a term I thought meant rapid sizable changing in market values. I now realize it doesn't. I now see it is the term used for the rate and extent of market prices falling or failing to increase at a desired rate. It took an analysis of price charts with the VIX chart to see this relationship.

Now when I hear the term used I see it is a euphemism used instead of the undesirable term loss or decline in value, by the market professionals whose career is based on the selling and management of market values. What would their job be if they were to advise clients to sell when the future of the market was obviously dismal? What the future of these people will be is to be seen, but I think many will be among the suffering of humanity as these unjust conditions resolve.

Back in the 90's when I married Lindea she had changed her job from financial advisor to teacher. We were stock and mutual fund holders. As we approached the turn of the century I studied the growth of market values and determined that the exponential growth could not continue forever. I persuaded her to let me get out of those investments. It was a good thing to do, even though no financial advisor agreed.

We are now going past a similar but far more bubble-like event with a much greater number of illusory market instruments, money supply pouring out of currency creation institutions, cryptocurrencies and cheap credit.

It looks like the day of accounting has arrived and there is little or no chance of continuing the false creation of wealth.

Credit creators and providers must now see the impossibility of sustaining the leverage, and instruments must be sold at decreasing values to try to cover the losses. Management must now recognize the global situation is beyond their control and report that the continuing growth is unsustainable. Regardless of the wailing and howling, the market values are likely to fall a long way and many fantasies will disappear from popular belief.

9 May 2022, I continue to see commentators claiming that the US economy is growing. I see it that the business economy is inflating.

There are acknowledgements that the gap between the rich and those in the lower ranks is growing. This says to me that even though the wealth at the top looks bigger, the economy is becoming worse and the numbers of people who suffer poverty is growing more evident.

I'm puzzled by the decline in the price of gold. How can the US$ grow in value while it is so evident that a large part of the business value is being lost and those with the leverage in financial markets are demanding the continuation of compensation? It reminds me of the story of lemmings running off a cliff. Even though it is clear that there is a continuing demand for easy money pouring into the hands of those buyers of the levered instruments, there appears to be no provider of credit that can continue issuing the money. I can't imagine any way the illusion of financial growth can be sustained.

9 May 2022, While watching the market programs today I see an attempt to say what is needed is to "repair to the damage". I wonder what the damage is. All I see is a market that appears to me to be overvalued by multiple and deca-multiple times. If this weeping and handwringing is taking place now with losses that takes it to levels of only two years ago, what will be the response when the markets really become truly valued?

The commentators are trying to assure the buyers of their services to remain confident. They talk about the profitability of companies, but fail to refer to who gets the money. If any company makes money, no matter how much, if it mainly goes to the privileged few who run it, how can it be seen as a benefit to stock holders. I see this situation as an illusion that the "market" has bought into most of my life. Eventually we get to a moment in time where this illusion cannot be supported by the economic system and we suffer a great resolution that lasts a decade or more.

At my age I expect only to see the suffering, not the recovery while I remain in this world.

I now hear the question "Can it get much worse?". I imagine that adjustment to good economic conditions means a great, very great, renovation of the market structure and a very great revision of the reality of social wealth—not just an increase of the unlimited wealth at the top.

5 May 2022, Today I see an agreement in the media to the undesirable "loss of wealth" due to the reducing prices of shares in the stock market. It engenders some to look for leaders in the economy to accuse of faulty influence.

I see as a fact that the "wealth" that is being lost has never been real. It is decades of building castles in the clouds. A long history of children fighting for control without a mature grasp of reality.

Nothing in the dialogue I hear addresses the reality of economic issues.

While trying to understand share prices I sse a need to also understand that most—if not all—shares are not the only investments in the market. ETFs and the like are also part of the system. What is the relationship of these to dividends?

Grim Thursday, 4 May 2022, is the day I'm starting to believe we are finally in the most severe correction zone of the economic conditions of a century.

For a long time I've believed it is necessary for humanity to grasp the nature of real economics which includes currencies, investments and other socially created instruments. Some like official currencies are real necessities and others like cryptocurrencies and ETFs are variations on illusions of the mind.

I accept that official money is the necessary lifeblood of a social economic system that is evolving into one global currency rooted to the value of gold.

I accept that capital investment to form socially beneficial companies is required for healthy conduction of business and the production of products and services for humanity, but the current stock market is designed to expedite gambling.

I also believe that the social regulation of money is necessary for fair alleviation of poverty. I believe that to have a fair and heathy world economy it is necessary to avoid the discrimination of "Capitalism" and "Socialism". A healthy global society can provide for poverty alleviation, labour and capital.

Division into ideological groups leads to unfair practices, conflict and sometimes deadly warfare.

I just cannot compartmentalize my view of economic beliefs. I see social economics as part of an intended divine creation.

Both Black Thursday and Black Tuesday are remembered for the Wall Street Crash of 1929. This day may become to be remembered as the Black Thursday of 2022.

I see the current social attitude of greed for unlimited wealth at any cost to be a mental illness that needs curing.